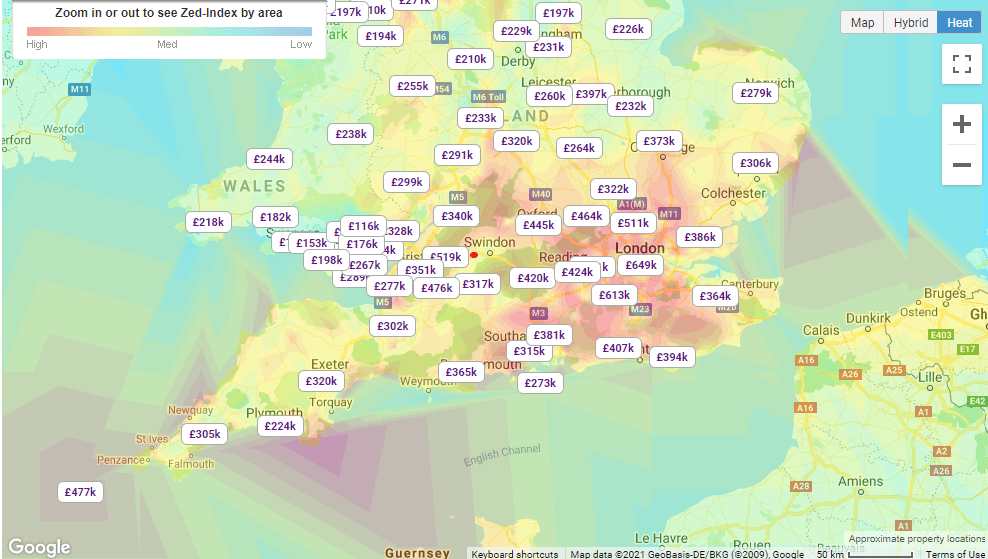

House prices are going through the roof, adding more than £30,000 to the value of an average home in just 12 months. That’s the verdict of one house price monitor – but the rest come up with different sets of numbers. So which house price index is the most reliable? The contenders are mainly household names – The government’s prestigious Office for National Statistics (ONS), The Nationwide building society, Halifax bank, online property giant Rightmove and e-surv, compiled by a leading surveying firm.

Are your rental homes performing better than average?

Statisticians seem to focus their attention on the price of an average home – whatever that is. But no one lives in an average home. The price depends on size, location, and property condition. In addition, many buyers may bring their must-haves to the table, like closeness to good schools and ease of commuting to work. The problem is, no one knows what an average home is – a realisation that means house price values repeatedly quoted in the media is nonsense.After all, where’s the average home in the diverse Yorkshire and the Humberside region? Don’t get carried away with double-digit price rises across the country because the increase doesn’t mean your property portfolio has magically soared in value overnight.

Comparing apples with oranges

One of the enormous problems with house price data is the quality of the sample – the source of the underlying data before analysis into a house price index (HPI). Each of the Big Five HPIs has weaknesses in their indices’ building blocks, skewing results:

- Sample sizes – the more limited the sample, the more inaccurate the data is. Banks, building societies and estate agents tend to rely on customer information. Halifax and Nationwide account for between 8% and 20% of house price sales in any month.

- Demographics – the location of customers can drag data askew. For example, a bank or estate agent predominantly having offices in London and the South will record higher prices than another based in the North of England or Scotland.

Further analysis

- Timing – Rightmove publishes data at the start of the month, the ONS publishes two months in arrears while the rest lag behind Rightmove by about a month. Different publication dates mean the trends reported in each HPI are for different periods.

- Affordability – Mortgage offers reflect the financial status of the applicant rather than the value of the home they want to buy.

Below is a list of the Big Five HPIs containing details of how they source their data:

- UK House Price Index – Compiled by the ONS and the Land Registry, the data is based on when a change of hands is registered rather than the date of sale. However, as the registration date falls 12 and 16 weeks after the sale, the data reflects the recent past rather than current trends.

- Acadata and e-surv– The statisticians call this the index of indices, pulling the data from several other house price reports, including the Land Registry. The index is based on the Your Move and Reed Rains estate agency chain LSL Property Services.

- Nationwide Building Society – The data for Nationwide’s HPI comes from the number of customers offered mortgages by the building society each month.

- The Halifax – Vies with Nationwide as the nation’s best-known house price index. The data is derived mainly from the bank’s customer base.

- Rightmove – Rightmove’s HPI is based on the asking price of properties listed on the firm’s website.

Unravelling house price data

House price data is an indicator of what’s going on in the market. You can get some idea of price fluctuations, but the data is not precise enough to give a value for a specific home. Even in a street of identical houses, prices can vary depending on the garden size, condition, and if the owner has fitted a new kitchen or bathroom. If a neighbour sells for £10,000 more than you, does that mean the house is better, or the buyer was inexperienced and pitched the offer too high?

ONS

The ONS/Land Registry data is considered the most reliable. The sample size is large and based on official data. But, the late reporting date can give a snapshot that’s too far in the past to be helpful. The Halifax and Nationwide reports have smaller samples based on customer mortgage applications, approvals and offers, while Rightmove draws from asking prices. All of these sources are considered less reliable than the ONS as they do not include the agreed sale price of a property but offer an average house price.

Why are there so many house price indices?

Organisations publish house price data for many reasons—about a dozen track house price changes in the UK. Up-to-date data gives valuers a benchmark to work from and helps economists with forecasting. Free publicity and brand awareness undoubtedly figure in the process for Halifax and Nationwide. These typically gain mentions in daily newspapers, TV and radio news.

How to value your property

Setting a sale price for a home is not an exact science. Most online tools will include data from the Land Registry, so going directly to the source cuts out the middlemen. The Land Registry gives the last sold prices for most homes. But, the data sometimes takes three months or more to update. Especially if you are looking for the price of a recently sold home. Property Price Advice is a website that returns an estimated current value for a home. Finding out the details involves filling in a short form.

Alternatives

Alternatively, dozens of other house price sites are available. But, most are designed to capture user data. Such as email addresses, as lead generators. You can keep tabs on house prices by asking a local estate agent for an opinion. Or, comparing values with nearby homes for sale you see online or in a local newspaper.

Want to know more about fees? Read our guide for landlords on Letting Agent Fees Explained.

Find out more about how Oasis Living can help you find the perfect tenants and improve your property management experience. Head to our website now or contact with one of our property experts. See our Guide on renting for tenants here!