One of the most common questions we are asked, particularly by first-time landlords and property investors, typically relates to the ideal duration of the tenancy. Should they opt for short-term lets, or aim to secure their tenants for as long as possible?

The lifeblood of your property income is sourced from your tenants paying their rent. The ideal scenario for every landlord is to have tenants who pay their rent on time. As well as having no issues throughout the tenancy. Keeping your tenants happy, and offering a line of transparent communication is crucial to ensuring rent is paid, and that your tenants leave your property in a pristine condition. This of course means that you are able to re-let your property quickly and inexpensively.

The nature of the rental market, however, is that every prospective tenant is different. On one end of the market are young couples looking to become small families. On the other hand are the elderly residents of the sector, who are looking to settle down and retire. The key difference, other than where they are along their personal life timeline, is the duration of time they are likely to stay in your property.

Examples

The young couple looking to become a family, are most likely going to need to upsize properties at some stage. Whether that’s in the next few months to settle down before a baby is due. Or in the next couple of years when needing to be close to certain schools.

The elderly residents will be looking to settle down into retirement, and likely won’t have any plans on moving soon. This poses a very high chance that they could be in your rental property for a significant period of time.

Add into the mix families who are looking to settle for longer periods of time, in addition to overseas residents with temporary work contracts looking for short term rental homes or rooms to let. The requirements of prospective tenants in the rental market are extremely broad. It can be difficult to cater to them all.

A report by property data consultancy firm, Dataloft, indicates that between 2020 and 2021, tenants spend on average 18 months in a rental property before moving on. Tenants in Scotland and North Yorkshire were found to spend the least amount of average time a rental property (16 months). Whilst tenants in Greater London were observed to spend the longest (20 months).

The report further highlights that initial rental leases of less than 12 months in London are remarkably rare. They account for just three per cent of new tenancies throughout 2020/2021.

Ultimately, it is up to you as the landlord of your rental properties to dictate the length of duration your tenants can remain in situ. Before doing so, however, it is worth knowing the key differences, benefits and disadvantages between short term and long term lets.

Short Term Lets

What is a Short Term Let?

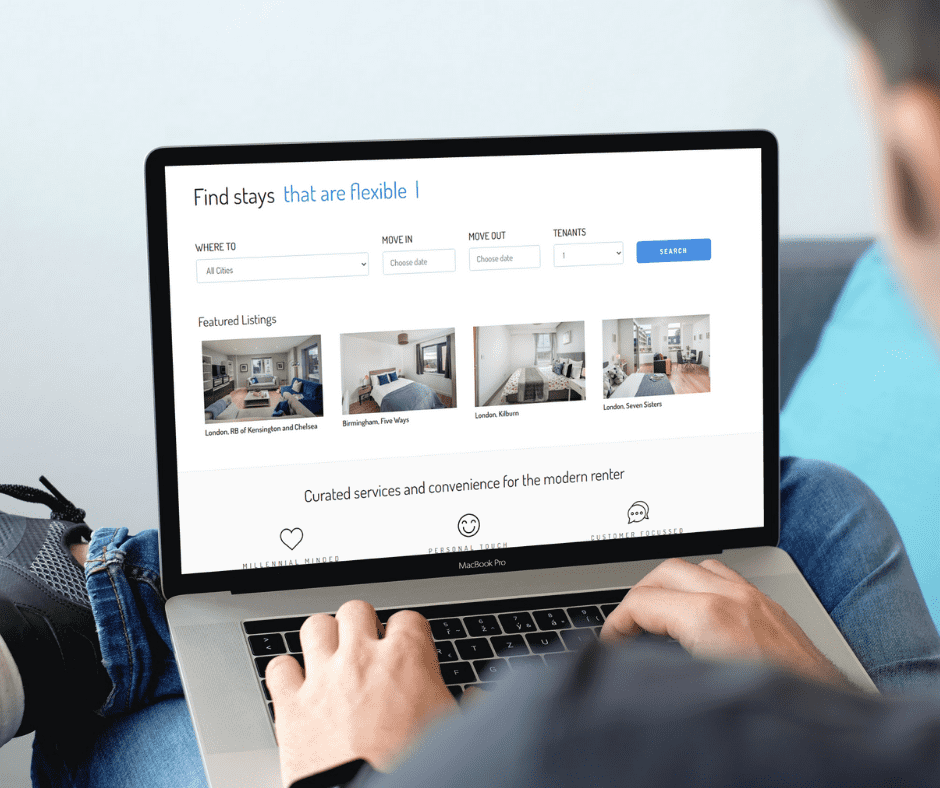

A short-term let is considered to be no more than 12 months, but more commonly any duration up to six months. From the perspective of a tenant, these are usually more difficult to find. Especially if they are seeking traditional houses or apartments. The boom of co-living environments and neighbourhoods across the UK, as well as the rise of the AirBnB platform, has however allowed tenants to tap into affordable, short term letting. If you are looking to let your property in the short-term, it is worth considering the competition from these developments.

Short Term Let – What are the Benefits?

Short term lets allow you as a landlord to eliminate the risk of prospective long-term troublemakers. If you are experiencing issues with your tenants, switching them out for more reliable tenants is a much easier task. Of course, this can be mitigated to some extent by working with a managing agent who carries out thorough referencing to prevent any unscrupulous tenants.

If the market takes an upward turn in demand and you wish to increase the rent, shorter tenancies allow you to do this easily at the end of the lease, and prior to re-letting. It gives you a degree of control over the financial income from your property on greater frequency.

Additionally, if the property you are renting out is also a holiday home you utilise, then you can benefit from the flexibility of tailoring the let periods around when you intend to visit and stay.

What are the cons of Short Term Let?

To put it bluntly, short term lets are not ideal for landlords looking for long-term stability. You may find your property is occupied by the most reliable tenants you could possibly be blessed with, but this may not last.

Time and committed effort are obviously recurring themes should you opt for a short term let. Your tenancy turnover will be much higher. Hence, you will need to be far more proactive to fill in the voids. Or have a managing agent in place who are well versed in short term relets.

On top of the heightened void costs, are other financial implications to consider on short term lets. End of tenancy cleans will be more frequent, and you may also find that the responsibility of bills falls to you as opposed to the tenant. This does, however, work in your favour with the wealth of prospective tenants who look for all bills included properties.

Furthermore, internal damage, wear and tear need to be considered in a heightened sense. The changing of tenants can mean different living styles, thus increasing normal wear and tear on your property. This of course means extra maintenance costs. You will, however, have the opportunity to regularly inspect your property more frequently. This allows you to identify any maintenance issues sooner, and address them swiftly and prior to any relets.

Long Term Lets

What is a Long Term Let?

Long term lets are tenancies that are typically over the 12 month period. These are commonly sought after by both landlords and tenants looking for stability and offer a number of benefits.

What are the benefits of Long Term Lets?

The main desirable benefit of long term lets for landlords is the passive, stable income. By keeping tenants in situ for the long-term, there is no hassle in re-letting the property and facing the fear of void periods. Building a solid rapport and communicating with your tenants is likely to keep them in place longer. This of course is great for your financial income. It pays off to do your due diligence when finding suitable long term let candidates.

Additionally, many Buy-To-Let mortgages have stipulations in place that can only be let to long term tenants. It is much easier to find mortgage lenders when securing tenancies for the foreseeable future, as opposed to sticking with a short term let.

You can also offset the cost of bills to the tenants. Thereby freeing you of an additional financial burden on your property.

What are the cons of Long Term Lets?

The actual rental figure of a long term let can be a downside. Short term lets tend to achieve higher figures than long term, which can mean higher overall income. Long term lets aren’t excluded from void periods either. Whilst short term lets may traverse through more void periods on an annual basis, there is no guarantee that your long term let property is safe from them either. Sometimes, you may also find the void period of your long term let could be higher than that of a short term let.

Additionally, you will have less control of your rental figure as a long term letting landlord. Legislation can be very restrictive of what you can and can’t do regarding your income stream when tenants are in situ. So, reviewing and changing your rental figure will be much more difficult.

And of course, perhaps the main concern for long term letting landlords is down to the tenants themselves. Short term tenancies give you a nearer doorway from which to bid tenants farewell; irrespective of how they have behaved and treated your property. With long term lets, the timescales of removing your tenant are far longer. Whether you are happy for them to leave of their own accord, or you wish to evict them through official legal means, regaining possession of your property is a lengthier process and not always an advantage.

Legislation

Looking at the legislation side of things, most short lets are set up as ASTs. The difference, is that there is far more emphasis in the industry on ensuring all the documentation is in order, and legalities met, for longer-term tenancies. Generally, short term tenancies don’t tend to fall back on these legalities at the end of a tenancy. This is because they are only there for a small amount of time. Thus, they can be more focused on making the next move.

Long term tenants, on the other hand, are far more invested in fighting tooth and nail to cause hassle at the end of tenancies (again, rightly or wrongly). This can involve in scrapping over pennies from a deposit you have rightly taken if they have damaged decoration, fixtures or fittings in the property. Landlords must meet Legal obligations if they are to avoid court appearances and prison time. Typically, this is a much greater risk for long term letting landlords. Thus, it is always beneficial to liaise with specialists who are able to guide you into compliance and operating on the correct side of the law.

Pros vs Cons

Evidently, it doesn’t matter which route you opt to take with your tenancy length. There are pros and cons that you need to weigh up personally. This is to ensure that it aligns perfectly with your property strategy. This also gives you realistic expectations when it comes to cash flow.

It is worth noting the change in a world where restrictions have eased following a global pandemic. Renters are now commonly looking for flexibility.

Offering flexibility in your tenancies is likely to appeal to a broader range of tenants. But, you need to clearly stipulate the terms and conditions of the tenancy within the contract.

When longer leases are concerned, it is important to stay orientated with inflation. As well as review your rental figures against the open market, as well as tracking against a rent index. This means that when your property becomes vacant, you aren’t missing out on income. Nor are you placing your property onto a market where the figure far outweighs the demand or the actual value.

More About Oasis Living

If you are looking to improve your property letting experience, Oasis Living are here to help. As always, our dedicated team of property management experts are on-hand to help guide you through your property strategy. We’ll also help you determine the best length of tenancy for you and your property. Whether you’re a first-time landlord or a seasoned portfolio investor, liaising with Oasis-Living helps to guarantee legality compliance when letting your property. We can find you tenants FAST and we also offer a property management service that includes free maintenance call-outs as a standard! Find out more about our mission to improve the property letting process for both tenants and landlords.

If you would like any more information, please reach out and get in touch, or phone +44 20 3936 9698.