The trick of how to work out landlord tax is knowing what spending you can offset against the rents you collect.

You don’t need an encyclopaedic knowledge of accounting to draft landlord tax returns, just a sensible head and a basic understanding of business and personal expenses.

Here, you can find out more about landlord tax and how to calculate rental profits if you invest in buy-to-let property.

What is rental income?

It seems obvious rental income covers the rents tenants pay, but some tenants pay extra if the landlord provides services like hot water, heating and looks after the upkeep of communal areas and gardens.

Include income from all buy to lets or houses in multiple occupation (HMO) that you own or part-own in the UK. Omit company-owned homes, holiday lets or property overseas – these have separate tax returns.

If you jointly own property, split the income ie if you own 50% of the home, add in 50% of the rental income from that property.

Which expenses can I offset against rental income?

Deciding which expenses to include when working out landlord tax is the key to paying less tax.

The rule of thumb is any expense is allowed – providing the amount was spent ‘wholly and exclusively’ for the property business.

A good place to start building a list of allowed expenses is with the HMRC guide Examples of how to work out income tax when you rent out a property. The guide takes landlords through how to claim several day-to-day expenses, like mortgage interest relief, repairs and replacing white goods.

Other expenses landlords can offset include:

- Utility bills in the landlord’s name and paid by them, not the tenants

- Buildings insurance, landlord contents, public liability cover and rent guarantee insurance

- Costs of providing services, like gardeners and cleaners

- Letting agent fees

- Legal fees for rental agreements running for 12 months or less

- Accountant fees

- Ground rents and services charges. Include your rent payments if you let a rent-to-rent property

- Advertising for tenants

- Office and administration costs, ie phones, printers, stationery and postage

- Business travel costs including a mileage charge

Like rental income, include expenses for properties you own, or part-own excluding company lets, holiday lets and foreign property.

Expenses that can’t be offset against rental income

Understanding which expenses you can’t offset against landlord tax is as important as knowing what you can claim.

Here’s a list of some of the common expenses claimed that are not allowed:

- Entertainment – You can’t include buying drinks, meals or gifts

- Mortgage loan repayments – Only the interest on the loan is allowed as a business cost

- Any private costs – like phone calls, clothes, travel, the cost of tools and home broadband

- Tenant deposits – these belong to the tenants and the money should be kept separate from a landlord’s business costs

- One-off improvements, like a conservatory or extension, including upgrades. An upgrade might be changing standard kitchen worktops for marble or granite.

These costs offset against capital gains tax (CGT) when the property is gifted or sold, and they are excluded from how to calculate rental profits.

Split expenses

Split expenses are where part of the cost falls to the business, but the rest is personal.

HMRC gives the example of a landlord buying tiles for a buy to let home. The store offers 12 square metres of tiles for £240 but the landlord only needs 8 metres for the buy to let. The landlord decides to use the extra 4 square metres at home.

The cost is split – the technical term is apportioned – so £160 is claimed as a business expense.

This is worked out as £240 divided by 12 to give the cost per metre (£20) and multiplied by 8 (The number of metres used privately).

Extra relief for furnished buy to lets

Landlords letting out a furnished buy to let can offset the cost of replacing furniture and furnishings against tax by claiming Domestic Items Relief.

Furnished means more than supplying light bulbs and curtains. A furnished property should have all the facilities a tenant needs on moving in with their personal belongings, from beds to teaspoons in the kitchen.

The claim covers:

- The cost of the new item that is a reasonable modern equivalent of the old item. For example, replacing an older TV with a new ultra-high-definition model

- Plus any delivery or installation costs

- Less any money received on disposing of the older item

The calculation works like this:

| Cost of replacement TV limited to equivalent cost of old item: | £500 |

| Plus associated purchase costs – delivery etc: | £20 |

| Less any money received for disposal of old item: | (£50) |

| Domestic Items Relief claim: | £470 |

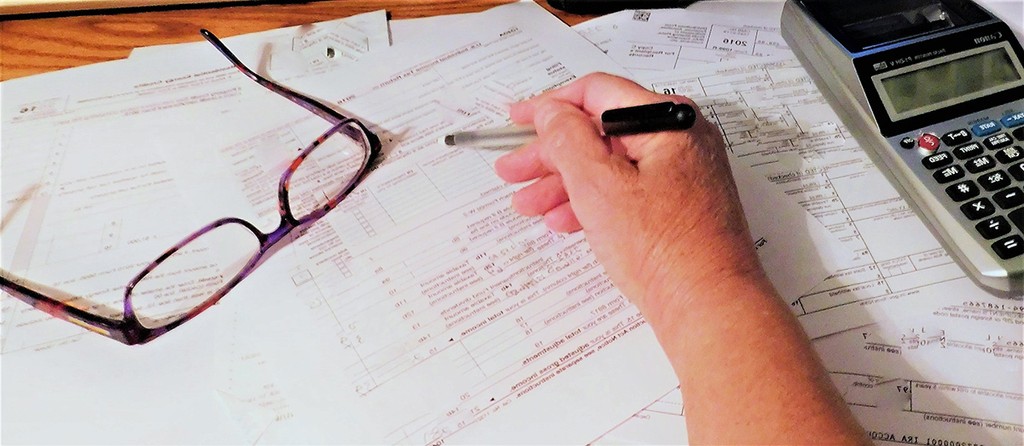

Keeping records for working out landlord tax

HMRC will expect you to keep comprehensive business records that support any figures inserted in a tax return.

That means filing the underlying documents, like tenancy agreements, bank statements, rent books, receipts and invoices.

If you claim mileage, you need a travel log as well.

The documents need to be retained for 5 years after the date they were filed. For example, if you file on the 31st of January 2021, you will need to keep hold of the documents until 2027.

You can keep digital or paper records if they are easily accessible.

Allocating income and expenses to a tax year

Landlord accounts are kept on a ‘cash basis’, which means income and expenses are included as they are incurred.

For the 2021-22 tax year, only income and expenses received or paid between April 6, 2021 and April 5, 2022 are included.

Working out buy to let rental profit

If you have kept accurate financial records, working out your landlord tax is a breeze.

The easy way of keeping records is to update them monthly so the pile of transactions does not get out of hand.

Here’s how you work out your landlord tax step-by-step:

- Add up all the rental income received during the tax year

- Add up all the allowable business expenses excluding mortgage interest

- Take the expenses away from the income to give a gross profit

| Property | Rental income | Expenses | Profit/loss |

| 1 | £7,000 | £5,000 | £2,000 |

| 2 | £12,000 | £6,000 | £6,000 |

| 3 | £4,000 | £5,500 | -£1,500 |

| 4 | £2,000 | £3,000 | -£1,000 |

| 5 | £10,000 | £5,000 | £5,000 |

| Total | £35,000 | £24,500 | £10,500 |

- Deduct 20% Mortgage Interest Relief worked out as 20% of the total mortgage interest paid.

For example, the landlord pays mortgage interest totalling £25,000 for the year. The tax relief is 20% of £25,000, or £5,000.

Offset the £5,000 against the £10,500 profit to leave £5,500

- The taxable profit is £5,500 and added to the landlord’s other income, if any, to give a taxable income.

For more information relating to your property income, see our article on Calculating Rental Yield.

Dealing with property business losses

It’s common for landlords to make a rental loss in the early years of their property business as they buy and refurbish homes.

Carrying these losses forward indefinitely will offset against the first available profits.

For example, a landlord makes a £20,000 Year 1 loss, a £2,000 profit in Year 2 and a £25,000 profit in Year 3.

First Year – no landlord tax is paid.

Second Year – the loss is reduced to £18,000 and carried forward after offsetting the £2,000 profit

Third Year – the loss is wiped out by the £25,000 profit, leaving a £7,000 property business profit.

Uncommercial lets

Homes offered to friends or family for free or with a discount are uncommercial lets.

Basically, they are tax neutral as HMRC assumes rent equals expenses. Until they are sold or gifted, you should not include uncommercial lets on a tax return when capital gains tax may fall due.

Find out more about how to work out landlord tax

If you want to get inside the mind of a tax inspector, check out the HMRC Property Income Manual online. The manual covers everything you need to know about working out landlord tax.

Keeping up-to-date with changes in legislation and property can be tasking as a property owner or tenant! At Oasis Living, we use tech and automation to make the letting process more efficient and less hassle for all involved. We offer premium property management, FAST tenant-find service and even free maintenance call out as a standard. Contact one of our property letting experts today to find out more. Alternatively, you can read more about our mission to improve the property letting experience, on our about page.